- Drinking Water 2024 – Summary of the Chief Inspector’s report for drinking water in Wales

- Foreword

- Water supplies and testing

- Compliance with standards

- Learning from compliance failures

- Learning from events

- Consumer contacts

- Asset health

- Water safety planning and risk assessment

- Raw water

- Poly and perfluoroalkyl substances (PFAS)

- Audit programme

- Recommendations

- Enforcement

- SEMD

- NIS

- Materials in contact with drinking water (Regulation 31)

- Research publications

- Whistleblowers

- Working with stakeholders

- Annex A – Number of tests carried out by companies

- Annex B – Compliance with standards

- Annex C – Compliance failures and events

Water safety planning and risk assessment

The Inspectorate’s Risk Assessment team’s function is to understand water companies’ water quality and sufficiency risks, adaptations to new requirements for mitigation and approaches to Drinking Water Safety Planning (DWSP). The team assesses large amounts of data and documentation submitted by companies. This information gives the Inspectorate the ability to act and enable companies to comply with regulations 27 and 28 using different types of audits including DWSP audits, individual line assessments (ILAs) of regulation 28 data, and legal instrument closure audits. By making assessments of all the above, the team can progress and maintain risk management practices across the industry. The team also issues guidance where necessary to help companies in their approach to compliance with the regulations regarding risk assessment.

Drinking Water Safety Plan (DWSP) guidance

The World Health Organization (WHO) published an updated Water Safety Plan (WSP) manual in March 2023. During 2024, the Inspectorate worked on revising DWSP guidance to incorporate the approach and continuing endorsement of fundamental components described in the WHO WSP manual. A draft of the new guidance was circulated to members of Water UK’s Drinking Water Safety Plan Forum to enable companies to give feedback on changes made. The new guidance aims to improve consistency in reporting DWSP data across the industry.

The feedback from the industry included needs for general clarification on wording regarding risk scoring, supporting documents to an overarching DWSP methodology and referencing, inclusion of the hazard ‘quantity’, nitrate/nitrite formula inclusion, hazard groups, regulation 26 turbidity inclusion, PFAS and pesticide reporting requirements and future risks. A working group was convened in December, hosted by Southern Water, where clarification for company queries was documented for feedback. The specific issues regarding hazardous events and a carried forward risk recording method was concluded. The working group also concluded that an annual return of regulation 28 data was not necessary. The upload data from the Inspectorate database shows many risk lines are skipped during the annual submission due to companies reviewing risks throughout the year. Companies may still submit an annual data set if they wish but this will no longer be a requirement following an update to the Water Industry (Suppliers’ Information) Direction due to be published in 2025.

The Inspectorate added a new category J to account for carried forward risks as part of this guidance and has also mandated the application of categories regarding regulation 27 and 28 notices. Category D must be applied to risks and/or risk lines with control measures identified by any regulation 27 or regulation 28 notice within three months of receiving a notice. Category E must be applied to risk lines for assets identified within regulation 27 and regulation 28 notices or whole company notices where specific parameters or control measures have not been listed, and a review of risks is required, also to be applied within three months of receiving a notice. The Water Industry (Suppliers’ Information) Direction 2024, incorporated regulation 28 reporting specifications. This enabled better tracking of the reporting requirements for the industry and separates DWSP guidance from the requirements for provision of information.

Audits

The Inspectorate continues to highlight recurring themes across all DWSP audits undertaken to date, including the variability and inconsistency of recording of risks across the industry and a continuation of reactive rather than proactive drinking water safety planning. Companies must move towards improved DWSP processes that proactively protect public health and ensure compliance for regulatory parameters rather than only maintaining a DWSP approach in retrospect of water quality or quantity issues.

The majority of DWSP audits to date have resulted in ‘minded to enforce’ and/or legal instruments being served to review regulation 27 risk assessments and regulation 28 reporting. The new DWSP guidance should address some of the inconsistencies that have been identified throughout the year and improve the quality of the information provided.

During 2024, the risk assessment team completed four audits on the DWSPs at Portsmouth Water, Southern Water, Dŵr Cymru Welsh Water and Northumbrian Water alongside Inspectors from the regional teams within the Inspectorate.

Portsmouth Water

Following a review of the company’s regulation 27 notice, it was identified that there were outstanding actions required to comply with the requirements of the notice. The company therefore continues to work on its surface water catchment risk assessments.

Southern Water

The Risk Assessment team undertook a two-day audit which comprised a day to assess the company’s DWSP, and a day’s technical site audit at Findon water treatment works and Tenants Hill service reservoir. A number of deficiencies were identified with the DWSP, the main areas highlighted included that although there was sufficient knowledge of risks within the company, this was not always reflected in the DWSP. There was a requirement for the company to produce an overarching methodology rather than rely on several separate documents which should be referenced within the methodology. The company demonstrated a lack of proactive risk assessment resulting in the company not proactively assessing all the company risks to drinking water supplies, and a strong reliance on sample results alone to identify risks. Other areas of concern included a lack of procedure around interpretation of bulk supply incumbent risk scores.

Dŵr Cymru Welsh Water

A two-day DWSP audit including a review of disinfection policy at Bryn Cowlyd works and a site visit to Pyllau service reservoir, resulted in a regulation 27 ‘minded to enforce’ letter. Whilst the staff present at the audit appeared to have a good understanding of the technical areas within the DWSP, several recommendations were made around the company methodology. These included the requirement to include details on how bulk supplies are risk assessed, definition of the assets and stages included in the DWSP process as well as any seasonal variations in assets in service, and information on how the DWSP process is conducted, all of which are fundamental elements of a DWSP. Other areas identified as needing improvement included documenting of training and competence, descriptions for triggers for action on risk identification, and the process for assigning risk scores and DWI categories.

Northumbrian Water

The assessing Inspectorate team were joined by colleagues from the Drinking Water Quality Regulator for Scotland (DWQR) for a two-day DWSP audit and technical audit at Mosswood water treatment works and Castleside service reservoir to understand how the company are progressing in delivery of their companywide notice for Hazard Review, developing and implementing their DWSPs throughout the hazard review process and to see evidence of improvements specific to Mosswood works.

The operational staff at Mosswood works and Castleside service reservoir were found to be very knowledgeable of these sites and the company have been commended for this. However, the key findings of the audit identified unacceptable risks associated with clarifier maintenance and wash water supernatant return, both of which present the risk of turbidity impacting disinfection and efficacy of significant barriers for the removal of Cryptosporidium. The audit also found that changes to the disinfection policy were required. As such, the Inspectorate issued the company with ‘Minded to Enforce’ letters covering the required actions for delivery under legal instruments yet to be served.

Risk Assessment Record (RAR) reporting and company breakdown of DWI categories

The annual submission of companies’ regulation 28 risk assessment report data took place in October 2024. Companies were able to use the online portal for the 2024 submission including uploading of their DWSP methodologies and declaration with Director sign off. There are occasionally issues with new processes for data submissions, however problems were easily resolved with good communication from companies and input from the Inspectorate’s Data Management Unit (DMU).

Companies’ risk assessment record (RAR) data is submitted using the DWI categories shown with definitions in the table below [Table 9] Companies must apply DWI categories appropriately to allow data to be meaningful and to give clarity in risk management. The risk assessment risk index (RARI) score multiplier is included in the table below along with an indication of whether the number of days a category is in place is considered in the RARI calculation. This shows that, for hazards not yet mitigated and verified (C, D, E), the RARI score multiplier increases a companies’ RARI score for those hazards significantly, dependent on the number of days these categories are in place. See the RARI section below for company scores.

Table 9 RARI calculation

|

DWI Hazard Category |

Description |

RARI Score Multiplier |

Days in Category used? |

|

A |

Target risk mitigation achieved, verified and maintained |

0.1 |

No |

|

B |

Additional or enhanced control measures which will reduce risk are being validated |

0.5 |

Yes |

|

C |

Additional or enhanced control measures which will reduce risk are being delivered |

2 |

Yes |

|

D |

Additional or enhanced control measures are required to materially reduce risk |

3 |

Yes |

|

E |

Risk under investigation |

4 |

Yes |

|

F |

Partial mitigation |

0.1 |

No |

|

G |

Control point downstream |

Not included in the calculation | |

|

H |

No mitigation in place and none required |

0.1 |

No |

|

I |

Future risk |

Not included in the calculation | |

|

J |

No mitigation in place, carried forward risk: control point upstream |

Not included in the calculation | |

|

X |

Risk record no longer relevant |

Not included in the calculation | |

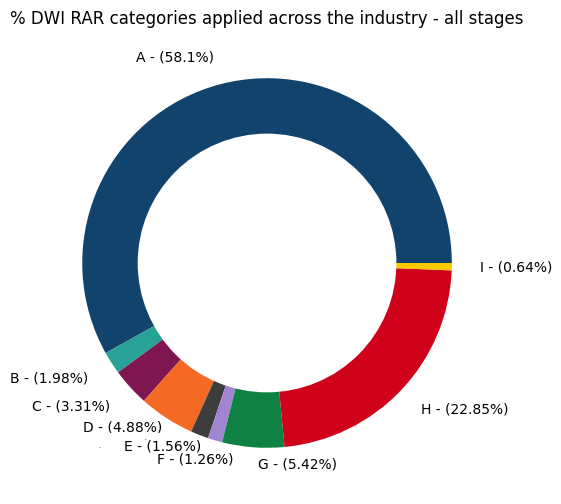

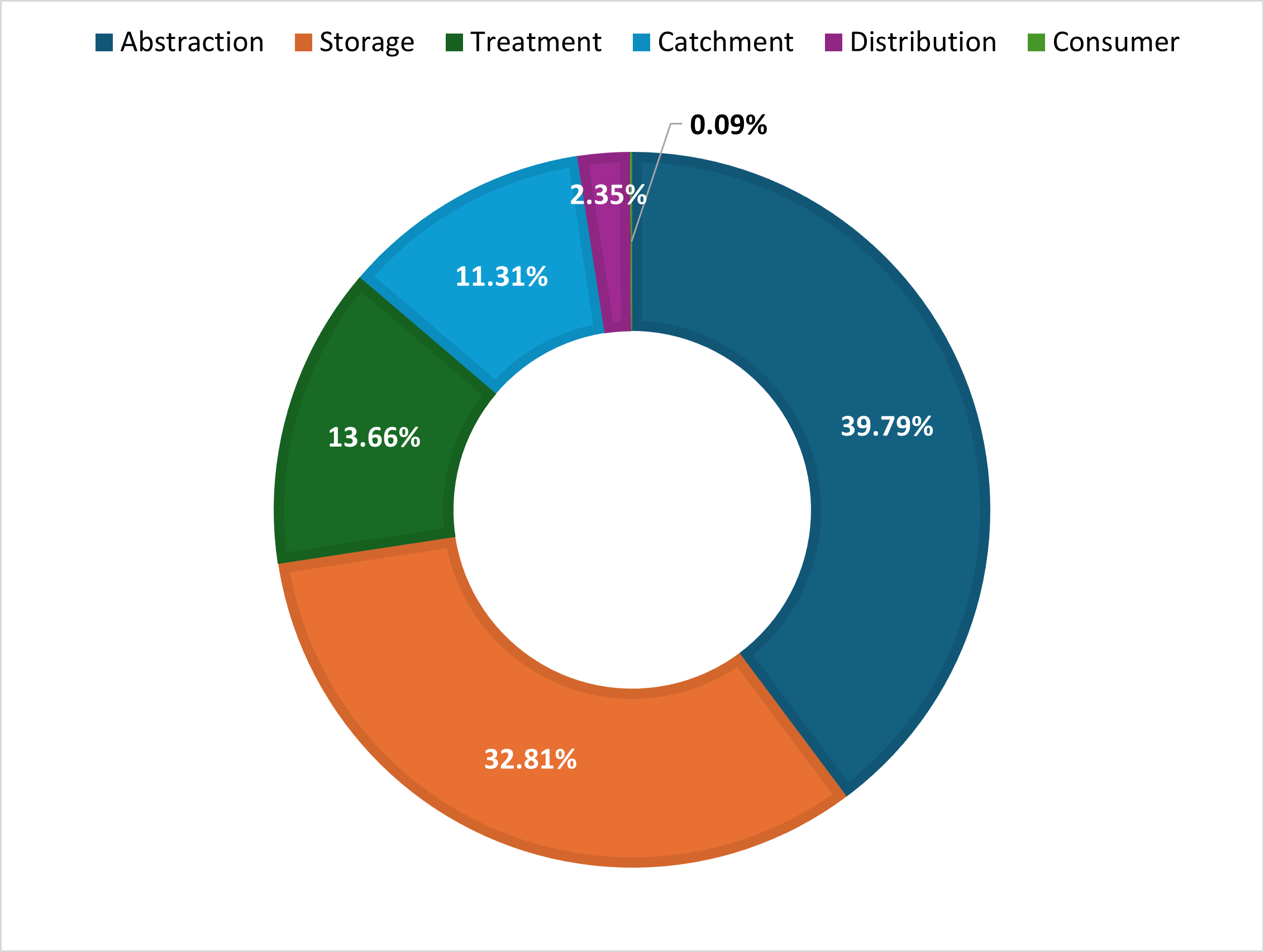

The pie chart in Figure 21 below shows that over half of the industry identified risks to water quality have verified mitigation in place.

Figure 21 – DWI RAR categories applied across the industry – all stages

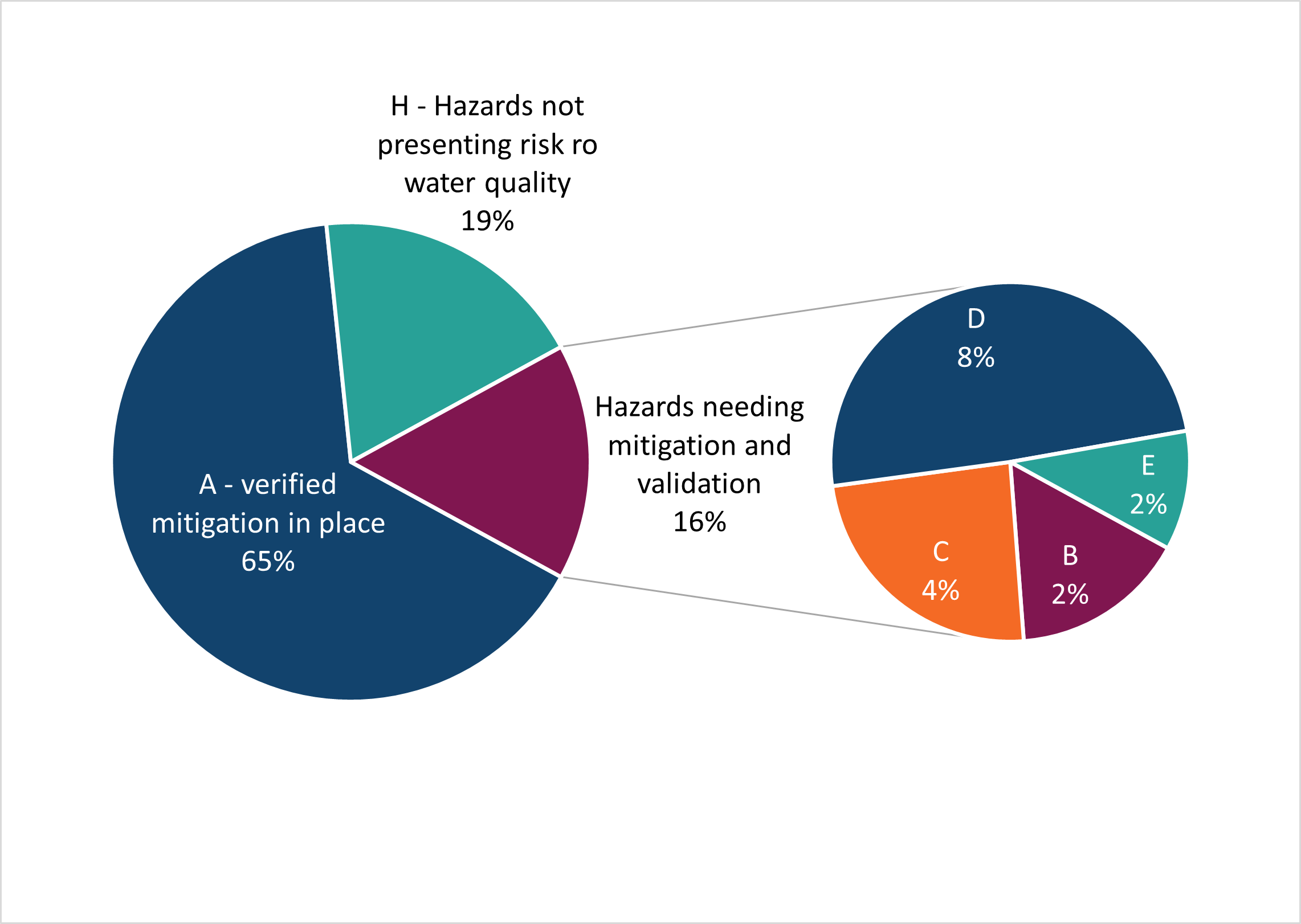

Figure 22 below shows the percentage of RAR categories across the industry at the treatment stage for England and Wales.

Figure 22 Percentage RAR categories for the whole industry at the treatment stage

Risk assessment record categories F, G, I and X have been excluded from the above Figure 22. Category F accounted for 0.18% of treatment stage risks across the industry where there is partial mitigation at this stage, usually these risks are also further mitigated downstream, and companies may use category G to also represent these risks. The percentage of category G risks at treatment works was 0.2%. These risks are typically hazards such as nitrate that can be mitigated by blending downstream of the treatment stage in company distribution systems. Category I risks made up 0.8% of the total risk categories applied at the treatment stage, although the use of this category may increase as the industry expands DWSP and records future risks to water quality and sufficiency of supply. Future risks are also discussed below. Category E has been included in the data described as ‘hazards needing mitigation and validation’, however there may be risk outcomes that demonstrate mitigation is not required.

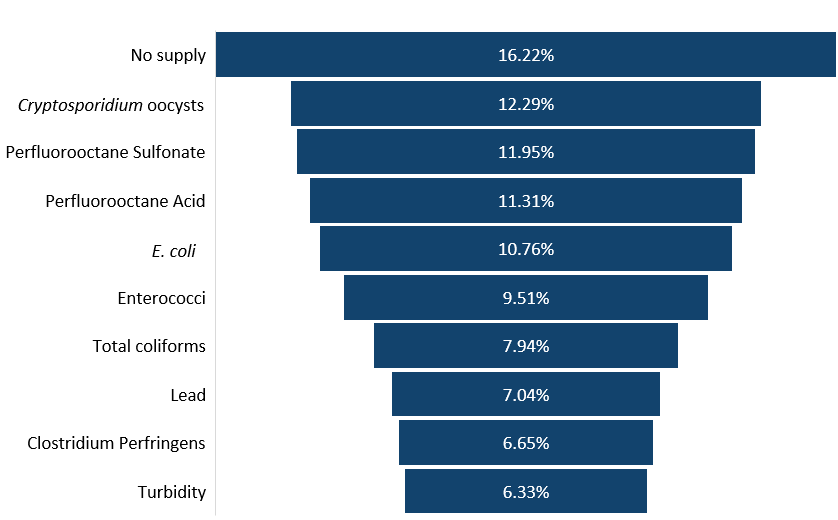

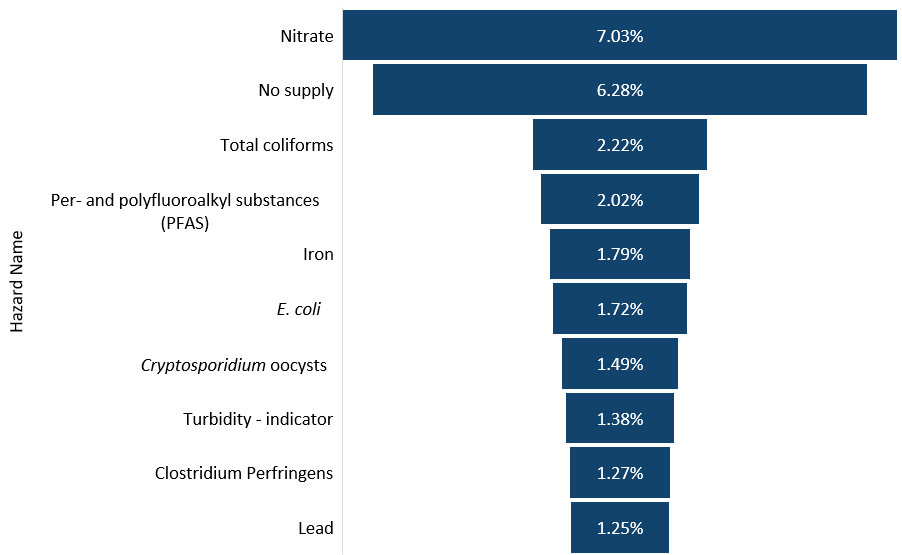

Hazards with categories C, D and E contribute to high RARI scores over time. As these categories indicate investigations into hazards (E), mitigation being needed (D), and solutions in the delivery phase (C). The longer the categories remain in place during this process, the longer there is a risk of water quality from these hazards. The top ten hazards in the section below show which hazards have the highest percentage of whole industry RARI scores. Category B risks may have had mitigation delivered, reducing the risk to water quality, however, the mitigation now in place for these risks is still being verified. Companies with regulation 27 and 28 notices must retain hazards at category B until the end of such notices, and the Inspectorate is satisfied through company completion reports that any hazards under notice have suitable control measures in place.

Risk Assessment Risk Index (RARI)

The risk assessment risk index (RARI) is dependent on DWI category application to risks perceived by companies. Companies are required to report risk assessments and show where risks are carried forward through supply systems from catchment/source to the consumer’s tap. Since the introduction of DWI categories, companies have used different methods to show carried forward risks. This is achieved either by using the DWI categories applied at assets with active risks and applying the same categories at downstream assets; or using residual risk scoring to demonstrate risks moving forward through a supply system. As such, RARI values for companies have not been comparable across the industry and can only show changes over time when viewed on an individual company risk profile. RARI has been reported for companies within the Chief Inspector’s annual reports over the last five years from 2019 to 2023. The index is a useful tool in showing active risks within companies and is being redeveloped as companies implement changes to how DWI categories are applied, gaining a more consistent approach over the next few years. This includes the introduction of a new category ‘J’ for carried forward risks. Although this category will not be included in the RARI calculations, it will allow for a more consistent approach within the industry for category application across company supply systems.

Figure 23 Top 10 current identified risks – whole industry

The top 10 hazards represent 39% of all hazards included in RARI calculations.

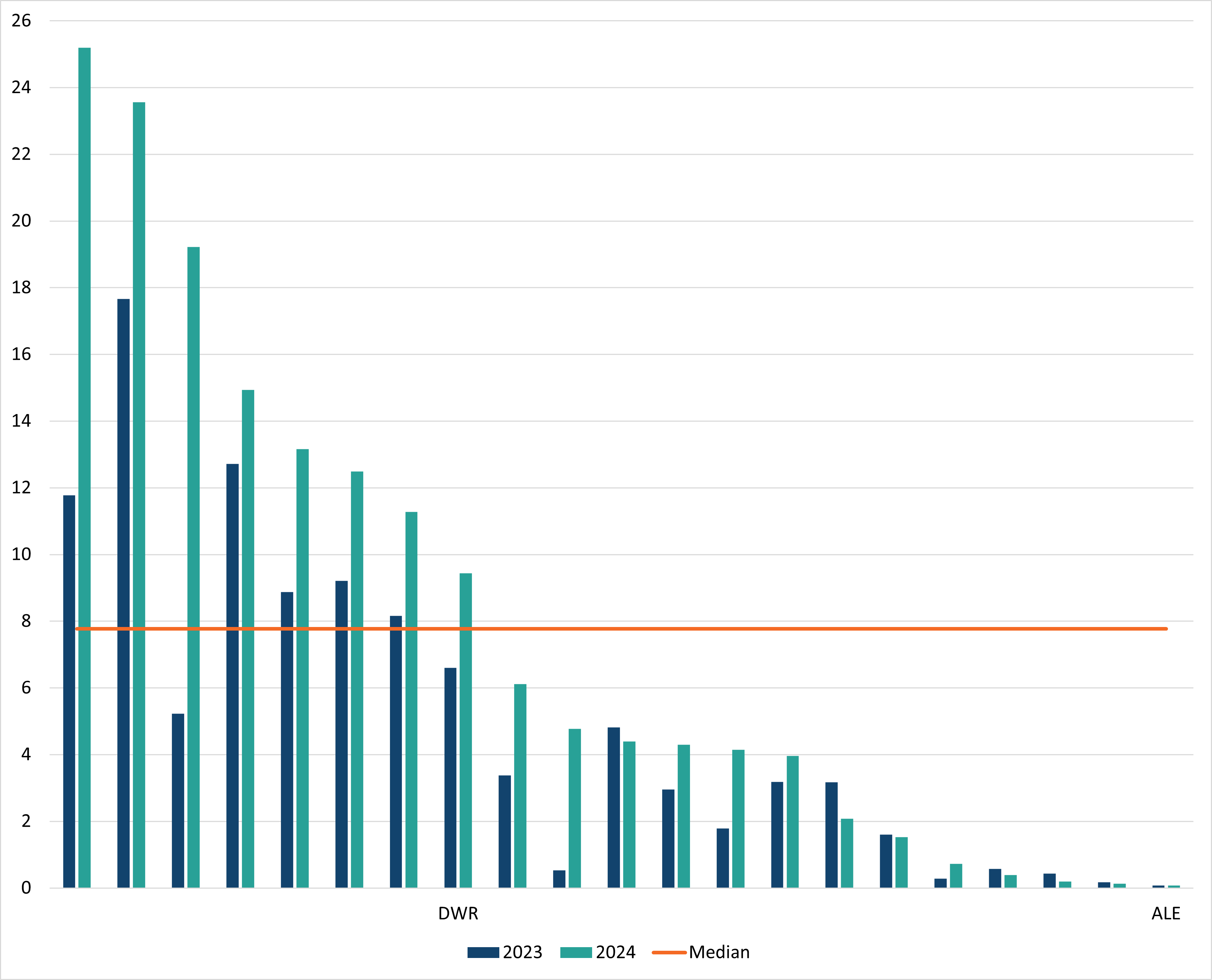

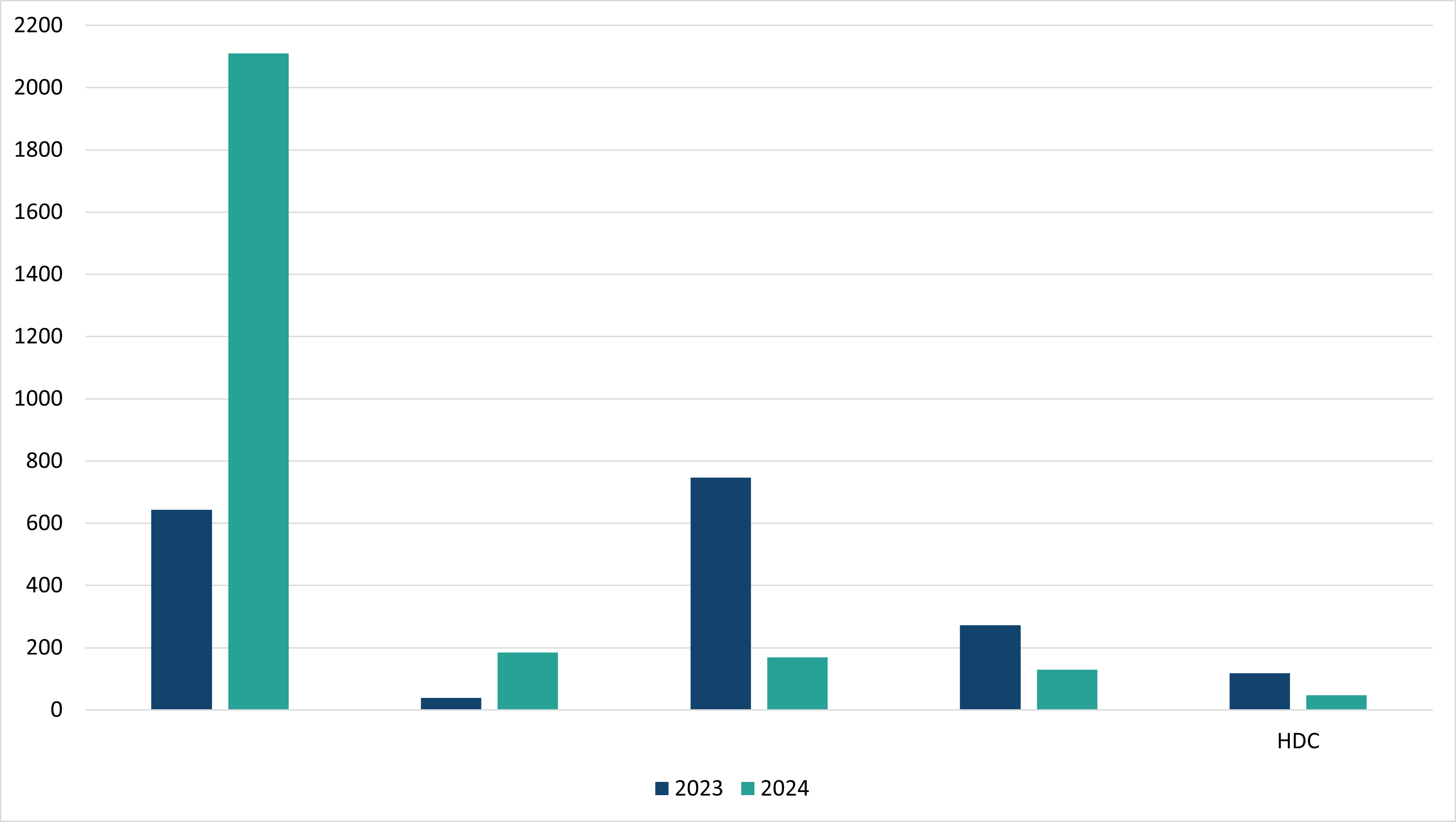

Company average RARI scores for 2023 and 2024 are shown below. The median value is 7.78.

RARI scores have increased for 15 out of the 26 companies shown in the above figures between 2023 and 2024 as the industry has increased hazard identification and recording of risks. This is likely to be the case over the AMP8 period through improvements made to hazard identification processes. These improvements may be implemented through Inspectorate legal instruments served on companies and/or development of approaches in line with newly published DWSP guidance. Companies must implement changes to recording and reporting risks in line with the Water Industry (Suppliers’ Information) Direction 2025 by February 2027.

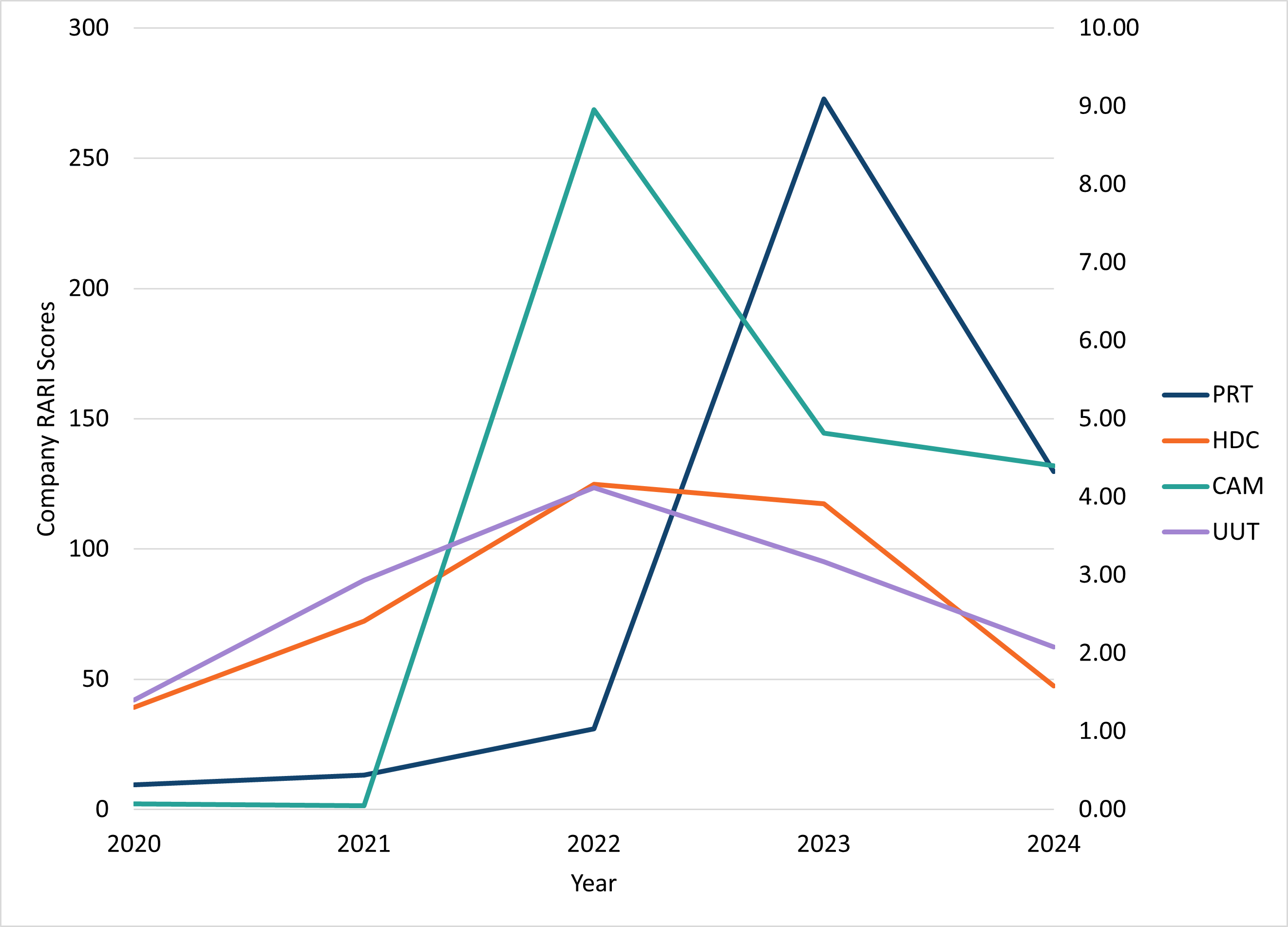

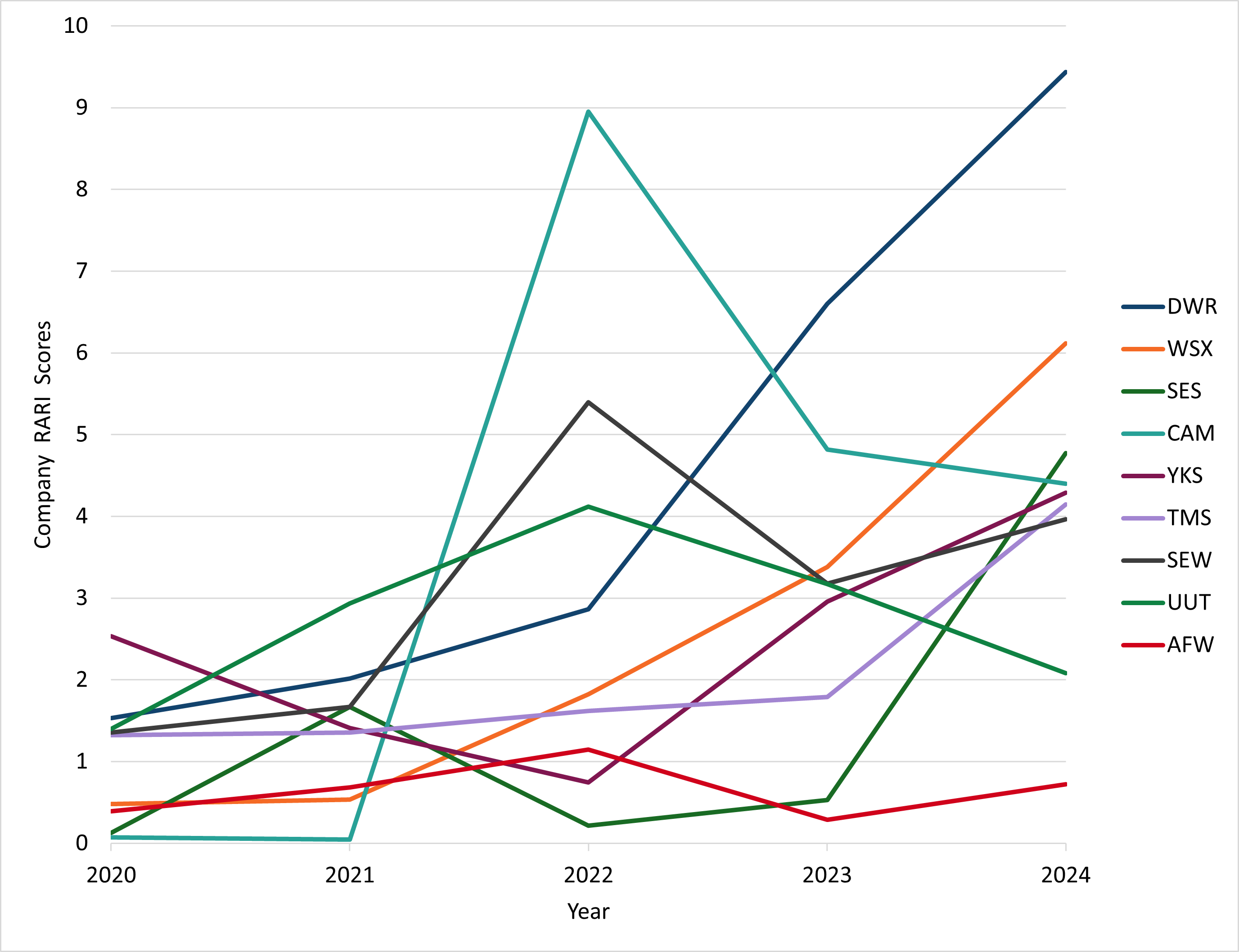

AMP7 RARI trends

The RARI trends across the AMP7 period shown below are indicative of where the Inspectorate expects companies to be. As companies continue to identify and record risks in their DWSPs, an increase in RARI scores is inevitable, as observed in 2023 and 2024. The Inspectorate expects to see company RARI scores vary over time as risk identification is improved and solutions to mitigate risks are delivered, downward trends will follow over future AMP periods as companies work through PR24 schemes and legal instruments. The rates of change in RARI scores will vary between companies as each has their approach to DWSP linking to investment plans and timescales for delivery of any control measures needed to reduce water quality risks.

Portsmouth Water and Hafren Dyfrdwy RARI trends are shown on the primary axis in the graph below (Figure 27) for scale alongside companies with similar trends.

Both companies have had high RARI scores over the last few years described below.

Hafren Dyfrdwy included risks identified through notices served in 2022 to their DWSPs, including a regulation 28 notice on individual service reservoirs and affected supplied zones, and a notice for concessionary supplies and installation of large water mains to supply areas north and south Lake Vyrnwy. As the company has made good progress with delivery of solutions under these notices, this is shown by a decreasing trend in their RARI scores from the middle of AMP7 to present.

Portsmouth Water was served a regulation 27 notice for catchment risk assessment and a management and training regulation 28 notice served in 2021, leading the company to identify and record these risks in their DWSPs shown by an increase in RARI from 2022 to 2023. The company continues to be on target with delivery against these notices indicated by a decrease in their RARI scores across their supply systems from 2023 to present.

Cambridge Water and United Utilities show similar trend profiles across AMP7 with RARI scores increasing during 2021 to 2022, followed by a decline in scores to 2023 as delivery of solutions conclude during 2025 and early 2026.

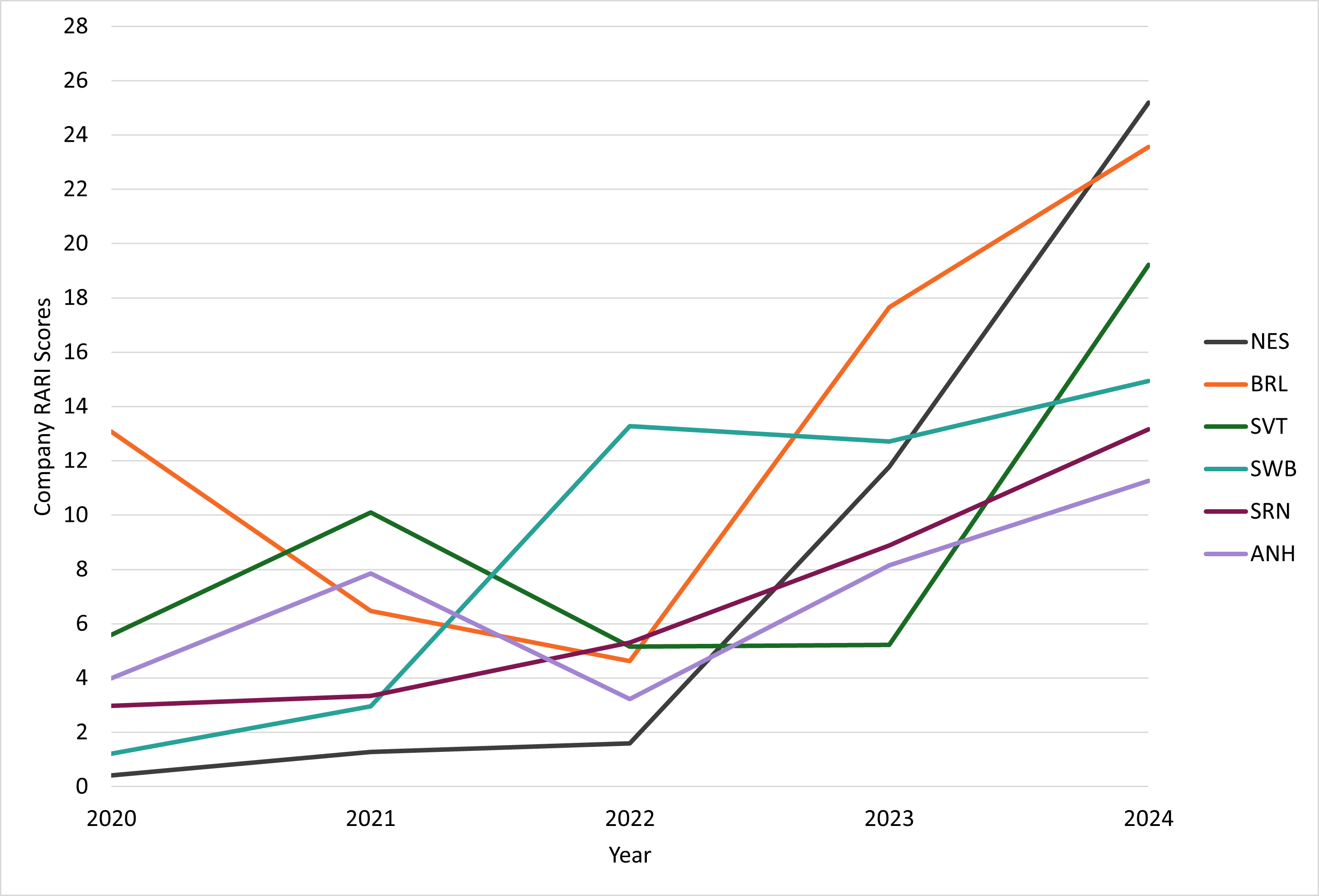

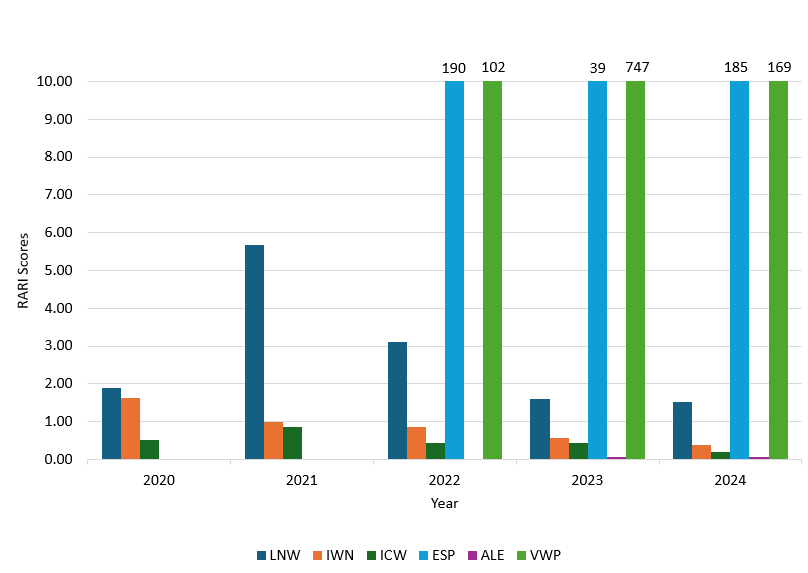

Companies shown in Figures 29 and 30 below show similar increases in RARI scores at the start of AMP7 to those in Figure 28 above, however further increases have followed from 2022 to present due to other legal instruments served during the AMP period and updates to ongoing notices for AMP7 continuing into the AMP8 period. Companies with RARI scores >10 at the end of 2024 are shown in Figure 28 below.

Companies with RARI scores <10 at the end of 2024 are shown in Figure 29 below.

NAV RARI score changes across AMP7 are shown in Figure 30 below. The figure excludes ESP Water, Veolia Water Projects and Albion Eco. Albion Eco continues to have a RARI score of 0.07 for the one site it is responsible for at Shotton Mill. ESP Water and Veolia Water Projects data are shown in the whole industry AMP7 RARI table above.

Future risks

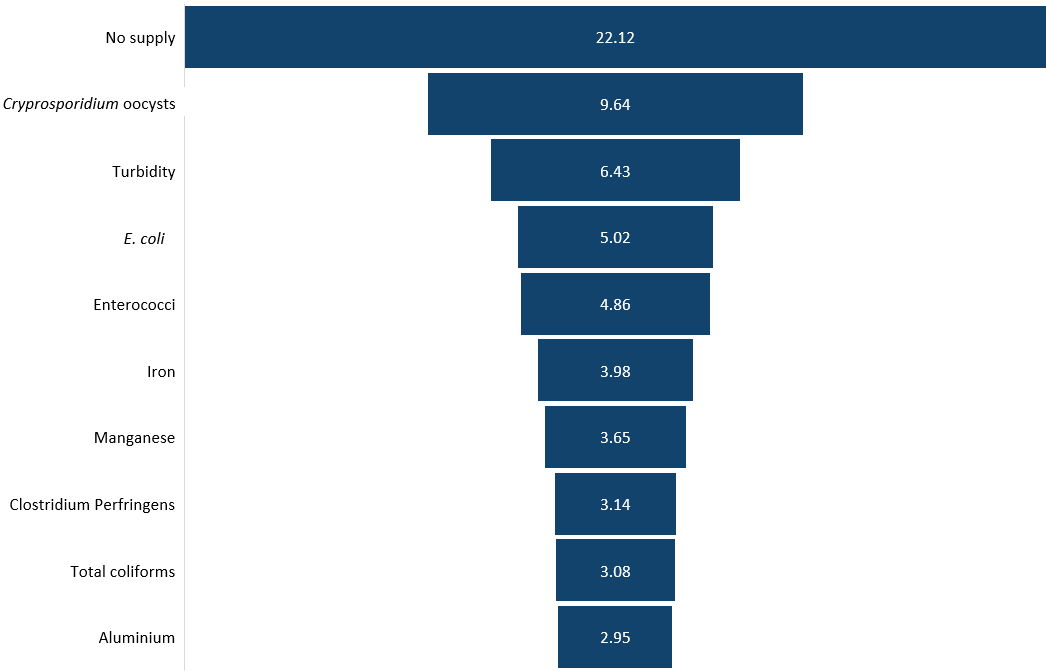

Seventeen companies use category ‘I’ indicating their individual perceived future risks that may need to be investigated and mitigated. Such risks include hazards that may be associated with emerging contaminants, climate change, changes in raw water quality and sufficiency, and asset condition and longevity. These risks are not necessarily manifesting now, but companies are keeping a watching brief over them. The top ten hazards where category I has been used in company submitted regulation 28 data is shown below.

The Figure 32 below shows that the highest proportions of company perceived future risks are from abstraction and storage stages.

Examples of these risks included single source contamination associated with nitrate risk, structural integrity of service reservoirs leading to a sufficiency of supply risk, and degradation of internal structures of boreholes causing a risk of iron in the raw water source supplied.